Introduction

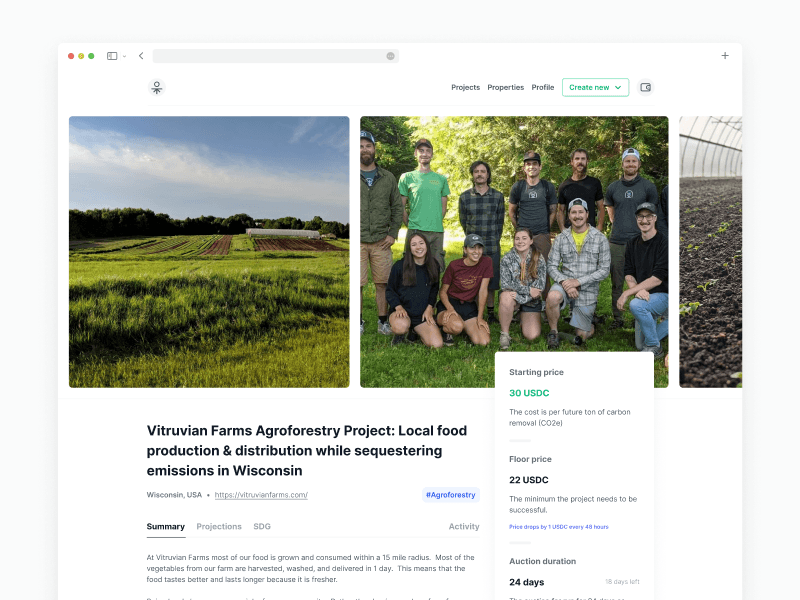

When looking at climate change critically, my co-founders and I saw a lot of opportunity to create structured financial products for carbon markets. There are inherently capital problems when it comes to solving climate change — Justifying the ROI is hard to do, and carbon projects are confusing. To make it super easy, we built out de-risking and pricing products to better understand carbon projects, and put those risks in simple terms via structured products that any capital provider could finance.

This helped us bring a number of projects to market, aiming for a net tonnage reduction of 2M - 5M tonnes annually over 20 years. The reality is carbon markets are tough, and they happened to collapse between 2022-2023. They will eventually rebound, but my co-founders and I disagreed on the future vision for Sequestr.

After winding down my role near the end of 2022, I ultimately departed the team as co-founder to join another company, it took me a while to fully leave Sequestr since there was a lot to figure out for the transition, I'm still on good terms with the team.

My Role

I was the co-founder, and sole developer on the project — I built out a Nuxt JS application, using Supabase as our database, and some internal tooling built on Airbase for managing projects. In addition, we built out risk and financial models which we could use as tear sheets for financing projects.

Designs